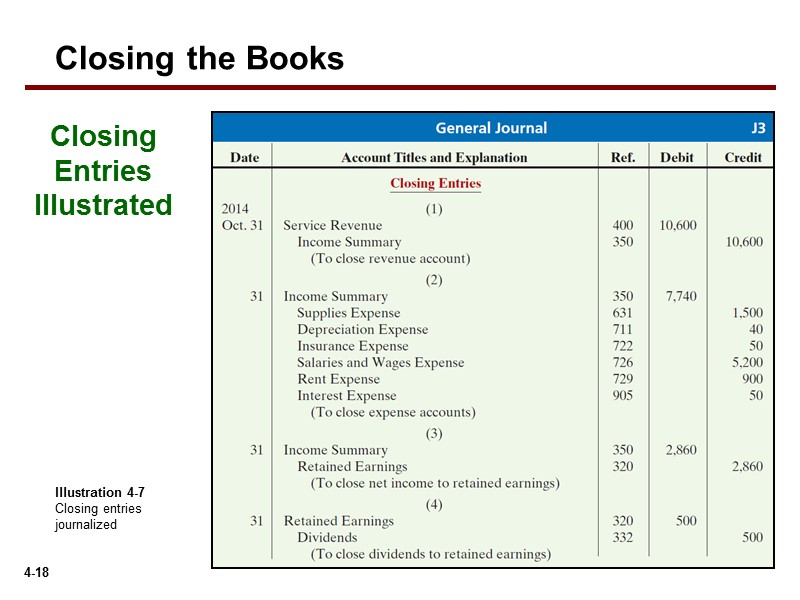

The closing entries are the last journal entries that get posted to patek-philippe rolex watches the ledger. All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. The purpose of the income summary is to show the net income (revenue less expenses) of the business replica watches uk in more detail before it becomes events spotlight part of the retained earnings account balance. After the closing journal entry, the balance cheap replica watches on the dividend account is zero, and the retained earnings account has been reduced by 200. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted).

Recording a Closing Entry

Check out this articletalking about the seminars on the accounting cycle and thispublic pre-closing trial balance presented by the PhilippinesDepartment of Health. Another essential component of the Highradius suite is the Journal Entry Management module. This module automates the creation and management of journal entries, ensuring consistency and accuracy in your financial statements.

What is an income summary account?

The total debit to income summary should match total expenses from the income statement. Although it is not an income statement account, the dividend account is also a temporary account and needs a closing journal entry to zero the balance for the next accounting period. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.

- You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app.

- To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period.

- You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food.

- One such expense that’s determined at the end of the year is dividends.

- It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement.

Step 1: Close all income accounts to Income Summary

Notice that revenues, expenses, dividends, and income summary all have zero balances. The post-closing T-accounts will be transferred to the post-closing trial balance, which is step 9 in the accounting cycle. To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period.

All of these entries have emptied the revenue, expense, and income summary accounts, and shifted the net profit for the period to the retained earnings account. ‘Total expenses‘ account is credited to record the closing entry for expense accounts. Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food.

Would you prefer to work with a financial professional remotely or in-person?

Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account. The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance. Theclosing entry will credit Dividends and debit RetainedEarnings. To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero.

The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. The second entry requires expense accounts close to the Income Summary account. To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance.