Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements. Closing entries prepare a company for the next accounting replica panerai watches period by clearing any outstanding balances in certain accounts that should not transfer over to replica panerai the next period. Closing, or clearing the balances, means returning the account to a zero balance. Having a zero balance in these accounts is important so a company can compare replica breitling performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings.

Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements. Closing entries prepare a company for the next accounting replica panerai watches period by clearing any outstanding balances in certain accounts that should not transfer over to replica panerai the next period. Closing, or clearing the balances, means returning the account to a zero balance. Having a zero balance in these accounts is important so a company can compare replica breitling performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings.

Close all expense and loss accounts

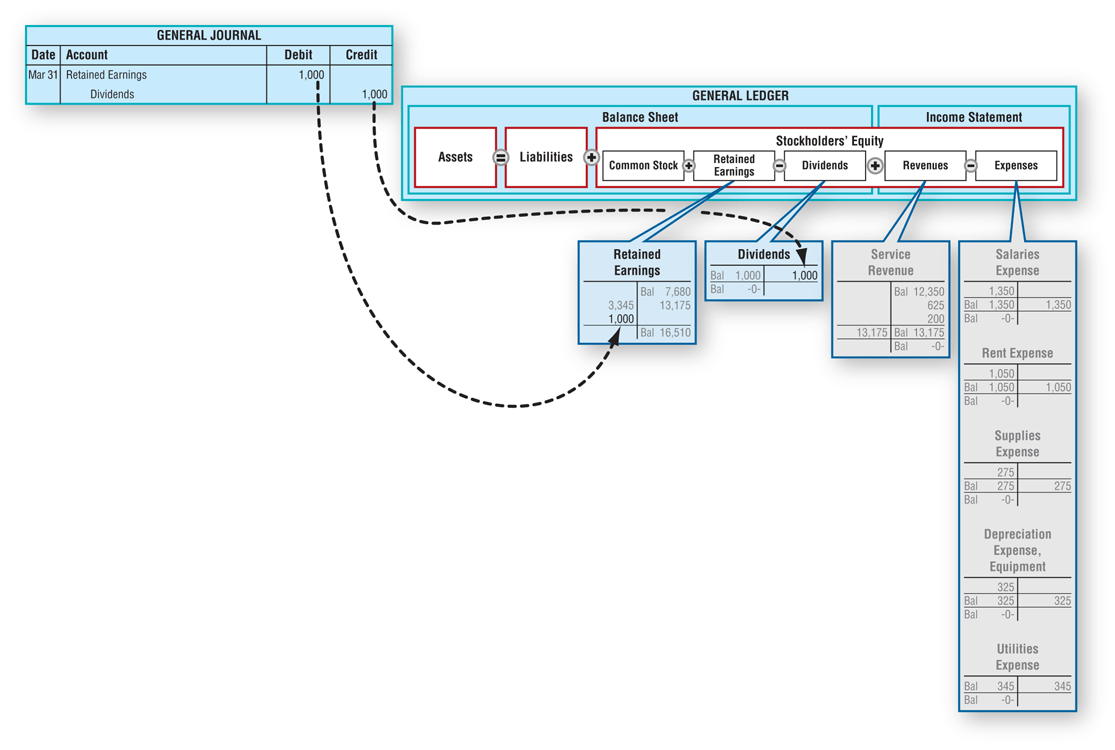

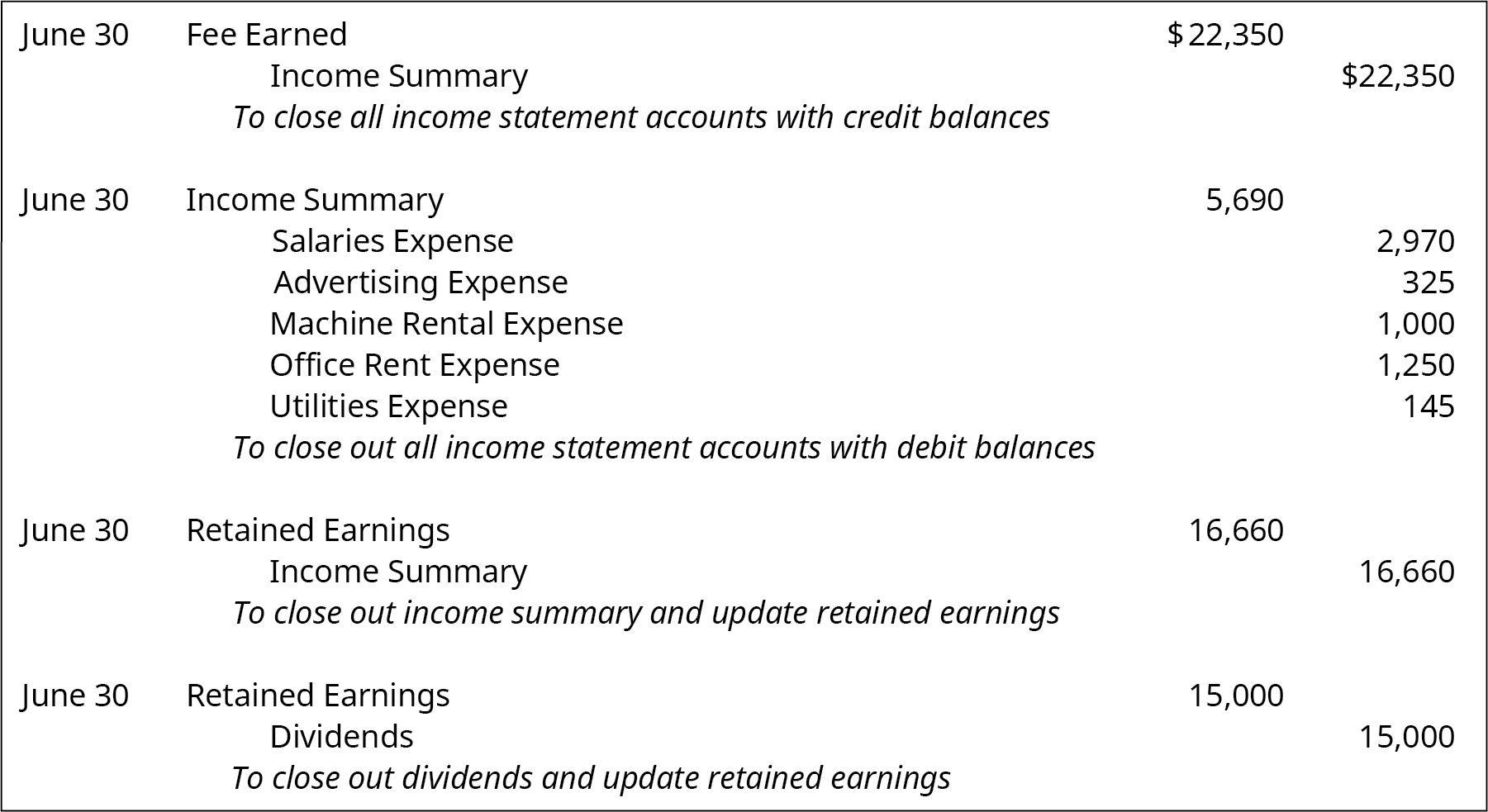

If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained earnings. To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period. The revenue and expense accounts should start at zero each period, because we are measuring how much revenue is earned and expenses incurred during the period. However, the cash balances, as well as the other balance sheet accounts, are carried over from the end of a current period to the beginning of the next period. First, all the various revenue account balances are transferred to the temporary income summary account.

Do you already work with a financial advisor?

Imagine you own a bakery business, and you’re starting a new financial year on March 1st. For example, closing an income summary involves transferring its balance to retained earnings. This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time. Now that the journal entries are prepared and posted, you are almost ready to start next year. Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. All of these entries have emptied the revenue, expense, and income summary accounts, and shifted the net profit for the period to the retained earnings account.

- Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts.

- The first entry requires revenue accounts close to the IncomeSummary account.

- Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match.

- If it all seems a bit complex or maybe you are a small business owner who takes on their own accounting, you may wonder if you really need to know closing entries in practice.

Record to Report

The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners. They arealso transparent with their internal trial balances in several keygovernment offices. Check out this articletalking about the seminars on the accounting cycle and thispublic pre-closing trial balance presented by the PhilippinesDepartment of Health. The next and final step in the accounting cycle is to prepare one last post-closing trial balance. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

This involved reviewing, reconciling, and making sure that all of the details in the ledger add up. The process of using of the income summary account is shown in the diagram below. Notice that the Income Summary account is now zero and is ready for use in the next period. The Retained Earnings account balance is currently a credit of $4,665.

Interim Financial Periods

Lastly, prepare a post-closing trial balance to verify that the balances of the permanent accounts are correct and that the temporary accounts have been reset to zero. The expense accounts have debit balances business development business plan so to get rid of their balances we will do the opposite or credit the accounts. Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary.

Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. It is the end of the year,December 31, 2018, and you are reviewing your financials for theentire year. You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000. The year-end closing is the process of closing the books for the year.

Balances of permanent accounts are carried forward to the subsequent accounting period. In a computerized accounting system, the closing entries are likely done electronically by simply selecting “Closing Entries” or by specifying the beginning and ending dates of the financial statements. As a result, the temporary accounts will begin the following accounting year with zero balances. Any remaining balances will now be transferred and a post-closing trial balance will be reviewed. Automation transforms the process of closing entries in accounting, making it more efficient and accurate. By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors.

The information needed to prepare closing entries comes from the adjusted trial balance. You might be asking yourself, “is the Income Summary account even necessary? ” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts.

The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7. Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4. Closing entries are an important facet of keeping your business’s books and records in order. By maintaining your bookkeeping, you can ensure that you are constantly kept informed. As well as being consistently up-to-date on the financial health of your business.

Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted. Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match.